![]() info@alkammulila.com

info@alkammulila.com ![]() Inquire about our services: +254 777 407 730

Inquire about our services: +254 777 407 730

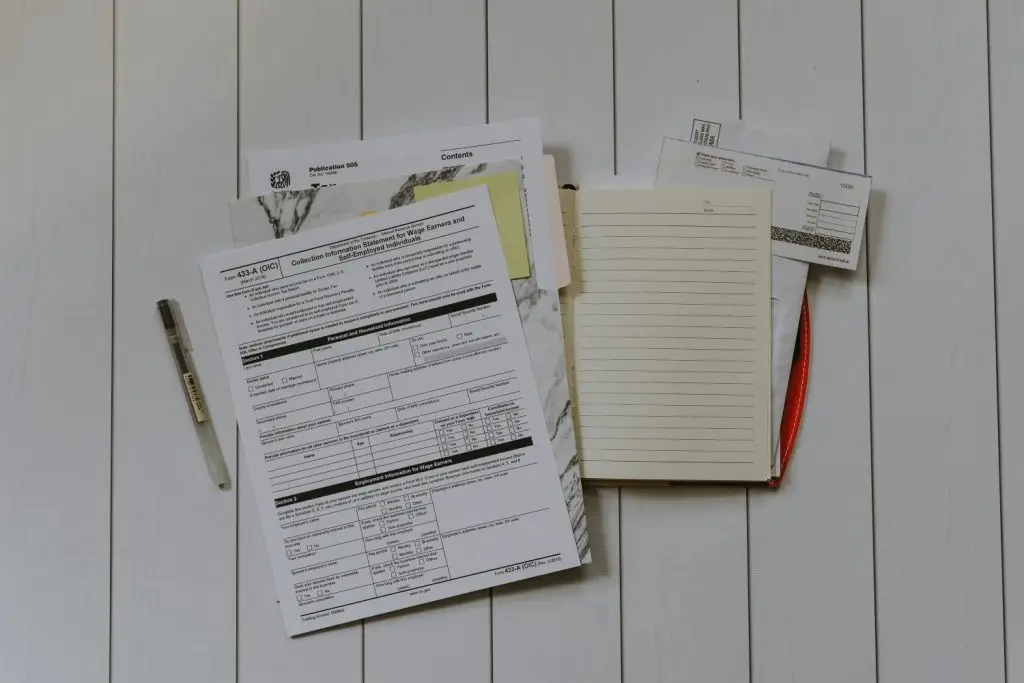

Keep Your Finances Organized with Alkam & Mulila LLP

Professional Accountancy Services in Kenya

At Alkam & Mulila LLP, we understand that accurate and reliable accounting is essential for running a successful business. Our Accountancy Services are designed to help you manage your financial records with precision, ensuring that you have the financial clarity you need to make informed decisions.

Why Accountancy Services Matter for Your Business

Effective accounting is about more than just keeping track of numbers—it’s about understanding your financial position, managing your resources efficiently, and staying compliant with regulatory requirements. We partner with you to maintain accurate financial records, streamline processes, and ensure that your business remains on solid financial footing.

Our Comprehensive Accountancy Services

We offer a wide range of Accountancy Services tailored to your specific needs.

Bookkeeping

Accurate bookkeeping is the foundation of sound financial management. We handle all your day-to-day financial transactions, ensuring that your records are up-to-date and organized.

- Record all financial transactions with accuracy.

- Maintain organized financial records for easy access.

- Ensure compliance with accounting standards and regulations.

Financial Reporting

Clear and accurate financial reporting is crucial for understanding your business’s financial health. We prepare comprehensive financial statements that give you a complete picture of your financial position.

- Prepare balance sheets, income statements, and cash flow statements.

- Provide insights into your financial performance.

- Ensure compliance with local and international accounting standards.

Payroll Management

Managing payroll can be complex and time-consuming. We handle all aspects of payroll processing, ensuring that your employees are paid accurately and on time, and that you comply with all payroll regulations.

- Process payroll accurately and on time.

- Process payroll accurately and on time.

- Manage employee benefits and deductions.

Tax Accounting

Proper tax accounting is essential for minimizing liabilities and ensuring compliance. We manage your tax records, prepare tax returns, and provide ongoing support to keep you compliant with tax laws.

- Maintain accurate tax records and documentation.

- Prepare and file tax returns on time.

- Stay compliant with all tax regulations.

Accounts Payable and Receivable

Efficient management of accounts payable and receivable is key to maintaining healthy cash flow. We handle invoicing, payments, and collections, helping you manage your cash flow effectively.

- Process invoices and payments efficiently.

- Manage collections to improve cash flow.

- Keep track of outstanding balances and due dates.

Budgeting and Forecasting

Effective budgeting and forecasting help you plan for the future and make informed financial decisions. We work with you to create realistic budgets and forecasts that align with your business goals.

- Develop detailed budgets to guide your spending.

- Forecast future financial performance.

- Monitor and adjust budgets to stay on track.

What to Expect from Our Accountancy Services

Our process is designed to be thorough, transparent, and client-focused. Here’s what you can expect when you work with us:

Step 01:

Initial Consultation

We start with a consultation to understand your business’s accounting needs and challenges. This helps us tailor our services to meet your specific requirements.

Step 02:

Financial Review and Analysis

We conduct a comprehensive review of your current accounting practices, identifying areas for improvement and opportunities for increased efficiency.

Step 03:

Implementation

We work closely with your team to implement the necessary accounting systems and processes, ensuring a smooth transition and seamless operation.

Step 04:

Ongoing Support

Accounting is an ongoing process, and we’re here to support you every step of the way. We provide continuous monitoring, updates, and advice to ensure your financial records remain accurate and compliant.

The Benefits of Choosing Our Accountancy Services

Accurate Financial Records

Our independent audits add credibility to your financial statements, which is crucial for investors and stakeholders.

Improved Cash Flow

With accurate and reliable financial information, you can make informed decisions that drive business growth.

Time Savings

Our audits help you identify potential risks and implement strategies to manage them.

Informed Decision-Making

We ensure your financial statements comply with all relevant regulations, helping you avoid penalties and legal issues.

Compliance Assurance

Our audits uncover inefficiencies in your operations, helping you optimize processes and reduce costs.

Who Benefits from Our Accountancy Services?

Our Accountancy Services are designed to benefit businesses of all sizes and industries. Whether you’re a small startup, an established corporation, or an individual seeking accounting support, we have the knowledge and experience to meet your needs. Here’s who can benefit:

Corporations

Startups

Non-Profits

Individuals

Small and Medium Enterprises (SMEs):

Testimonials

What Some Of Our Client’s Say About Our Accountancy Services

James Mwangi, CFO, ABC Manufacturing

“Alkam & Mulila LLP has transformed our accounting processes, making them more efficient and reliable. Their attention to detail has been invaluable.”

Esther Nyambura, Finance Director, MNO Enterprises

“With Alkam & Mulila LLP handling our payroll and financial reporting, we can focus on growing our business. Their support has been a game-changer.”

David Kimani, Managing Director, Global Tech Solutions

“The team at Alkam & Mulila LLP has made managing our accounts effortless. We trust them completely with our financial records.”

Have any questions about our services? Ask us or find your answer here...

What is the difference between bookkeeping and accounting?

Bookkeeping involves recording daily financial transactions, while accounting encompasses the broader process of managing financial records, preparing financial statements, and ensuring compliance with regulations.

How can accountancy services benefit my business?

Accountancy services help you maintain accurate financial records, manage cash flow, prepare for taxes, and make informed business decisions. This can lead to improved financial performance and compliance with regulatory requirements.

What do I need to prepare for an accounting consultation?

For an accounting consultation, you should prepare recent financial statements, tax records, and any specific accounting challenges you want to address. Our team will guide you on any additional information needed.

How often should I update my financial records?

We recommend updating your financial records regularly—at least monthly—to ensure accuracy and compliance. Regular updates help you stay on top of your financial position and avoid surprises.

Can Alkam & Mulila LLP handle payroll management for my business?

Yes, we offer comprehensive payroll management services, including processing payroll, managing employee benefits, and ensuring compliance with tax and employment laws.

INDUSTRIES

Ready to streamline your accounting? Contact us today for a consultation.

Free Call Now

+254 777 407 730